- cross-posted to:

- technology@beehaw.org

- cross-posted to:

- technology@beehaw.org

I know this is more business than tech related, but for some reason I am not able to post it to the business community, so I’m posting it here.

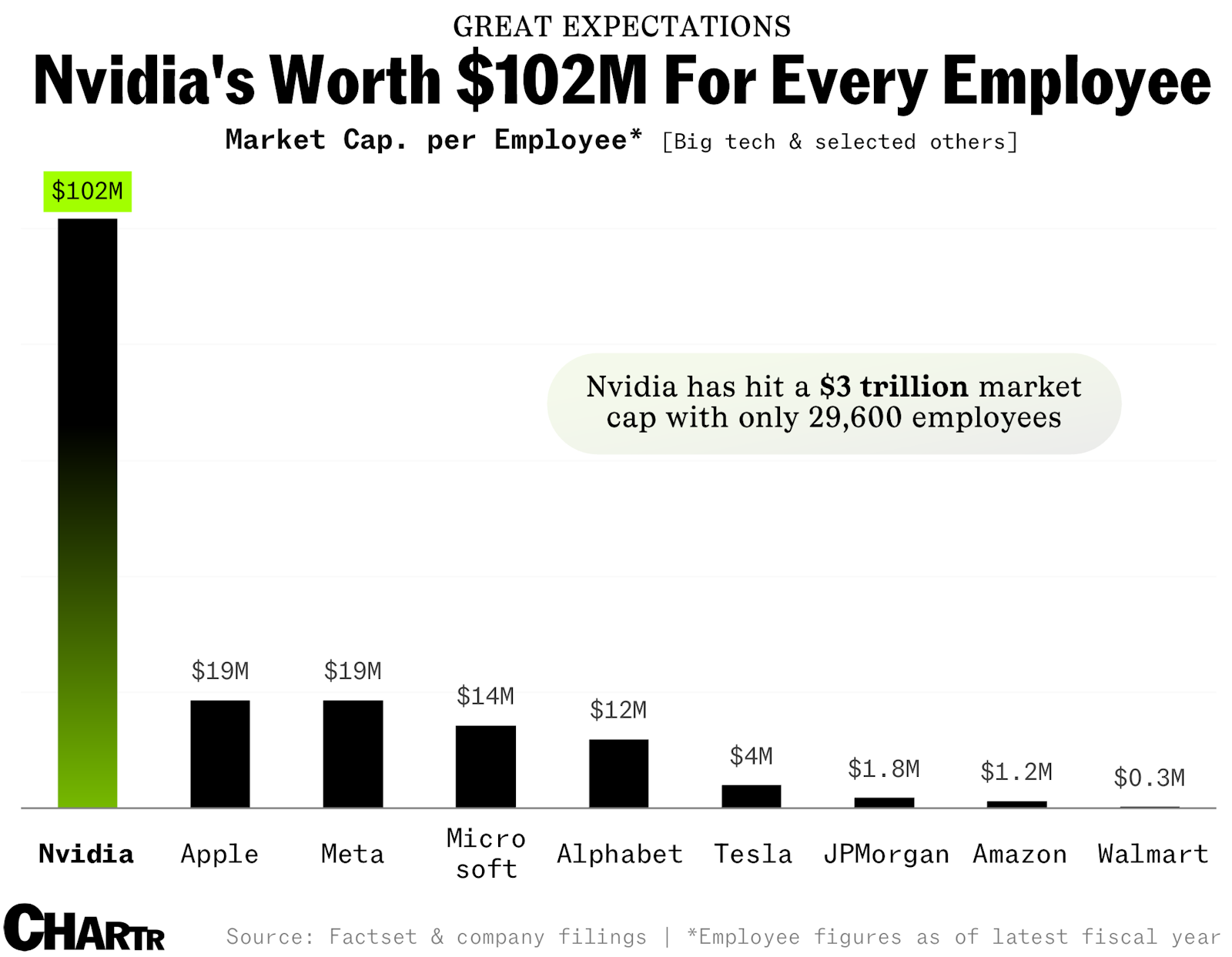

"…For Nvidia, after this latest run-up took it north of the $3T milestone, the company is being valued at more than $100M for each of its 29,600 employees (per its filing that counted up to the end of Jan 2024).

That’s more than 5x any of its big tech peers, and hundreds of times higher than more labor-intensive companies like Walmart and Amazon. It is worth noting that Nvidia has very likely done some hiring since the end of January — I think the company might be in growth mode — but even if the HR department has been working non-stop, Nvidia will still be a major outlier on this simple measure.

We are running out of ways to describe Nvidia’s recent run… but a nine-figure valuation per employee is a new one."

And every employee will recieve the industry standard 3% raise based on performance at the end of year.

I’m like 90% sure Nvidia employees get stock options, but I’m not sure if that’d be the case for the newest batch of hires.

But yeah, this is a clear cut illustration of how salaries undervalue the actual labour provided, I don’t think any Nvidia employee’s getting 100M from their stocks + salary.

RSUs are kinda shit too though. According to coworkers at my company that are actually valued enough to receive them, they’re pretty difficult to sell

Very true. I personally know two people who were at Nvidia who have retired/are in the process of leaving now, and it hasn’t been a hassle for them personally. That obviously doesn’t speak for everyone ofc.

I also think Nvidia wants to buy back as many shares as possible from their employees like every other big public tech giant is doing right now.

From this, it describes someone losing half a billion dollars which would leave them with over 300 million. That doesn’t sound too bad and is unrelated to difficulty with RSUs.

I linked you the wrong thing, sorry 🤦 I meant to link a reddit thread discussing employee RSU rates at Nvidia, but now I can’t find it because Google AI has decided that I don’t need to see that anymore.

I’m sure you can find it if you google (again sorry), but there was definitely a lot of mixed bag experiences on it, you’re right. The people who got in by 2015-2016 and got some seniority are making out like bandits now.

RSUs cannot be sold, but they can be vested.

deleted by creator

Ummm, nope. Some might, but not everyone by a longshot. Salaries aren’t great either.

Hmm, interesting, are you able to expand on that at all? The people I know who are retiring have been there a decade or so, I’m wondering what newer hires are experiencing.

I don’t know about Nvidia specifically, but I mostly only see RSUs offered to Staff/Principal level engineers or Director and above on the management track. Many times with a multi year vestment period to act as a retention tool. You can make out good at the exiting end of the deal.

IMHO its a shitty practice. There is risk if the C-level pulls some stupid shit tanking the stock. The reward could just as easily be distributed to employees with a profit sharing bonus that eliminates the risk of my options tanking while vesting. Let the employees convert to options if they want to stake on future company performance.

At least in the US, I could have used the value of my options earlier in life to help with student loans, buying a house, medical issues, having kids, etc. I grew up poor. I “pulled myself up from bootstraps” and am doing well now. I still think the whole system is a dumb gimmick.

You guys get raises?

Yes and if your employer doesn’t give you one you should leave.

At least the article points out that this is a Wall Street valuation, meaning it’s meaningless in reality, the company doesn’t have that much money, nor is it actually worth that much. In reality, Nvidia’s tangible book value (plant, equipment, brands, logos, patents, etc.) is $37,436,000,000.

$37,436,000,000 / 29,600 employees = $1,264,729.73 per employee

Which isn’t bad considering the median salary at Nvidia is $266,939 (up 17% from last year).

Book value doesn’t take into account future value, wall street value does

Meaning speculation. Just because someone is willing to buy Nvidia stock at a $3 trillion valuation doesn’t mean it will someday achieve that kind of tangible value.

The problem is believing in some kind of objective, “tangible” value.

You don’t have to believe in objective tangible value. However, there’s clearly a difference between a vegetable farm and a cryptocurrency. The former makes something and provides services. The latter does not. These are extreme examples of market and value distortion. The very existence of crypto is a nail in the coffin of the neoliberal theory about rational markets.

What’s the difference, really?

The market ultimately dictates value

The difference is that the stock market has a very distorted definition of value.

If you say that the value of something is what someone else is willing to pay for it, I could trade my house with a friend and say they paid a billion for it, except they paid me with their own billion-dollar house, and we would both become billionaires. Of course, that would be bullshit, but if my friend and I sat on the board of the FED, it would somehow become actually real.

I see how that works, but the question is, how far can that stretch? Wall Street already tells us there is stuff worth more than 40 years of the US GDP trading around in their pockets, so how much more can that get before they get called on their bullshit like me and my hypothetical friend?

I could trade my house with a friend and say they paid a billion for it, except they paid me with their own billion-dollar house, and we would both become

billionairestaxed into poverty.Except we would grab loans from our banker friends who are also in on the scheme, and use some of that money to pay taxes and buy some congresscritters to avoid further taxes. The banker guys would then grab some loans themselves, preferably also from each other, as they slowly repackage the whole thing and then sell it to retirement funds to make it everyone else’s problem. /s

It’s a ponzi scheme

In which we all participate whether we like it or not.

Cool. I am glad to know I imagined the real estate crash of 2007.

Ish, over the medium to long term Nvidia will have to start paying dividends that align with the cost of the share. Otherwise the market will leave for better paying, lower cost stocks.

At least the article points out that this is a Wall Street valuation

Market cap is not just a “Wall Street valuation” (whatever that means).

meaning it’s meaningless in reality

Tell that to the stockholders.

The stockholders don’t live in reality either

The AI bubble

Nvidia is in a great spot for the AI bubble.

It drives up prices now, but when the bubble eventually burst, data centers are still going to need accelerators for more viable compute tasks.

Absolutely the most robust business in the bubble.

The AI bubble powered by the US military budget.

Valuation per employee…doesn’t pay the employees their worth. Or anywhere near it.

I was excited that the employees were logged as primary shareholders. Like every employee in every company should be.

Personally I’m an AMD guy, I don’t like the proprietary approach Nvidia takes to everything.

But I have to admit, Nvidia has been on the ball for 30 years now, and it’s very impressive what they have achieved.

I think the rest of the industry needs to pool together around an open standard, if they want to have a chance to compete against the near monopoly Nvidia has because of CUDA.Is there anything fundamentally superior about Cuda over open CL?

Yes: market share. And Nvidia has the top performing cards on the market, so there’s no reason to go with a competitor.

And inertia. Same reason x86/64 is still the king. Nobody wants to update their software to a new architecture

Exactly. People will do it if there’s a big enough incentive, but that just doesn’t exist for openCL.

I am not an AI programmer so I can’t really say. But CUDA had a head start and was some years ago allegedly the best combo with Nvidia hardware for AI programming. Over a period of time a lot of companies/projects have come to use CUDA, and so it has an advantage both for compatibility and know how among many AI programmers.

It’s kind of like how X86 has maintained a market lead on desktops and servers, despite ARM being very competitive. The change of API is disruptive and costly, so people stay with what already works.

Me too! Sadly I have 0 employees.

https://feddit.uk/post/12865710

[The execs and above are] Well compensated for pouring jet fuel on climate disaster.

Delete Nvidia